Abril - Acompanhamento da Safra e Exportações Brasileiras

Overview

Crop development:

The harvest is almost completed in the state of São Paulo, which represents about 80% of the total production in Brazil currently.

Reports by the growers and shellers will often divide this harvest in three thirds: The first third being the best, with great yield and quality, some occasions yield being higher than 4,5 mt/ha and very few quality issues. In the second third, the damage caused by the February drought (20-30 day without rains in some regions) began to appear, the yield decreased, and aflatoxin issue were reported more often. During the last third the situation got even worse, reports of yields lower than 2 mt/ha and aflatoxin issues even more frequent.

Despite all the reports, it is still early to have a good estimation on contamination distribution, average yield, and total production, the main numbers that the stakeholders are looking for.

Nevertheless, it seems that good shellers (with controlled supply chain) could be looking at such distribution: 50% EU quality, 30% outside of EU and 20% for crushing.

Average yield estimations are of about 3,2 mt/ha, which, with a planting of 400 thousand hectares, would result in 1,28 mi tons of inshells. However, as in past years, we will see estimations of yield and area fluctuate to try to explain market behaviors.

Exports:

The advancement of the harvest, as expected, would bring up the export numbers. March figures showed about 15 thousand metric tons of peanuts exported. And a much higher and welcome increase in peanut oil exports, with about 10 thousand metric tons shipped.

Graphs and analysis below:

Peanuts

Total

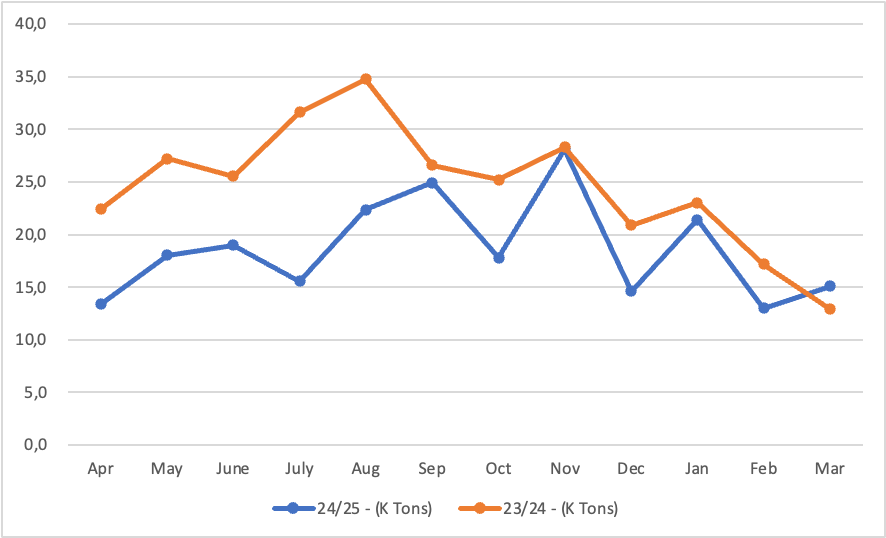

Peanuts export in 2024/2025 x 2023/2024

Brazilian exports of peanuts, NCM 12024200, Ministry of Agriculture.

During March 2025, Brazil exported 15.1 thousand metric tons of peanuts, a 17% increase compared to March 2024 (12.9 thousand tons).

The progress of the harvest and the improved availability of new product are now reflected in shipping volumes. Despite the concerns about productivity and quality in some areas, exporters have returned to the international market more actively.

If the expectation of volume for this crop is fulfilled, it will be importante that the export numbers keep rising, especially for peanut kernels, from which one could see more potential for improvement than the peanut oil, which has been stagnant or decreasing in the last two years.

Nevertheless, things are changing for the oil perspective...

Destination

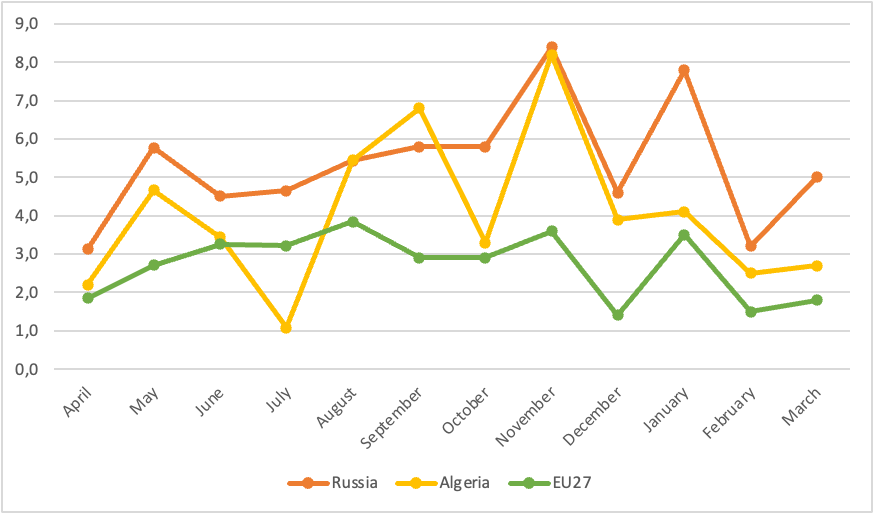

Exported volumes to main destinations.

Brazilian peanut exports in March were mostly directed to Russia, Algeria, and the European Union. After the sharp drop seen in February, volumes partially recovered in March across all major markets:

- Russia imported 5.0 thousand tons, up from 3.2 thousand in February.

- Algeria imported 2.7 thousand tons, slightly above the 2.5 thousand in February.

- EU27 imported 1.8 thousand tons, compared to 1.5 thousand in the previous month.

Peanut oil

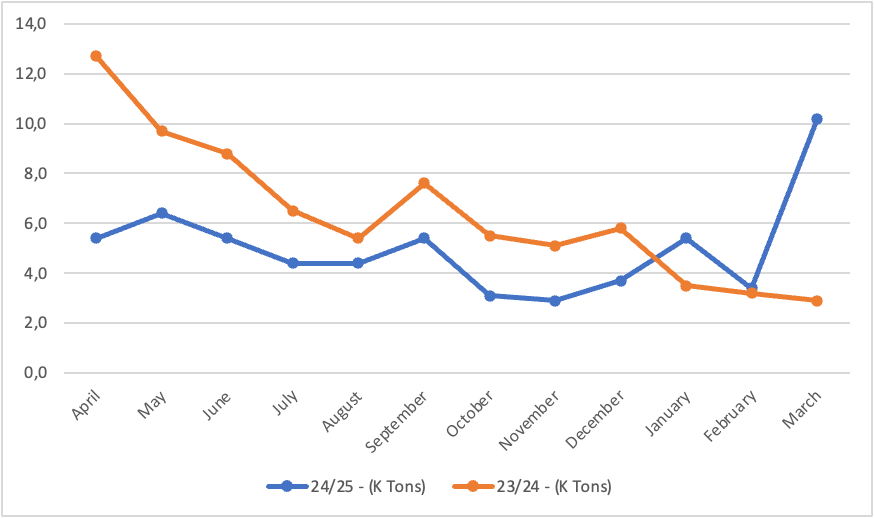

Peanut Oil export in 2024 x 2023

Exports of peanut oil in March were of 10,2 thousand metric tons, this is a 252% increase compared to the 2,9 mt exported in March 2024.

During the past weeks, a higher activity from peanut crushers was noticed in the procurement of raw material. The aflatoxin issues and decrease in prices for raw material, boosted by the decrease in international prices for kernels, certainly helped the crushers to get this good increase in shipments, and of course, an obvious increase in demand by China, certainly influenced by the USA tariffs.

Destination

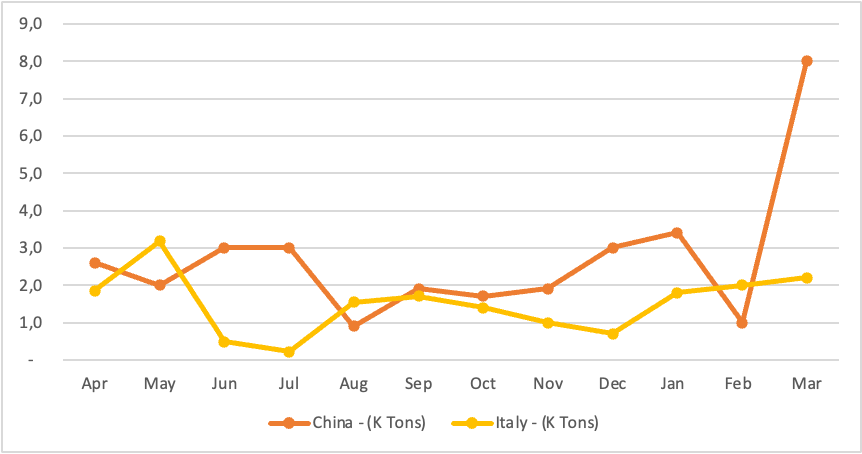

Exported volumes to main destinations.

It is clear to see that during the last crop year, no importer was able to buy much more than 3 thousand tons in one month. Now we see China importing 8 thousand metric tons. For some time I have been saying that if someone can change the picture quickly in theis industry, it is China with its oil imports.

We are left to see how that goes in the next months. And, as a reminder, 10,2 metric tons of peanut oil could mean about 25 metric tons of crushed peanuts.

Disclaimer: All the information published is checked with many processors and farmers in Brazil, there are no personal opinions but an average of the market’s main players thoughts. May 5th, 2025.